How recessions impact returns

25th August 2022

In its August 2022 update, The Bank of England (BOE) said it forecasts the UK to enter a recession in the final quarter of the year. The word “recession” now appears among Google’s most searched for terms worldwide. It may go some way to explaining which emotion is driving markets today – but are we right to fear a recession?

What is a recession?

A recession is a slowdown in an economy. Typically, this is regarded as two consecutive quarters of shrinking Gross Domestic Product (GDP).

Recessions happen for different reasons, but they are commonly regarded as a normal part of the business cycle. Current concerns are being driven by higher inflation, stalling growth and rising interest rates.

Recessions and stock markets

Stock prices are influenced by many things, but one factor is the state of the underlying economy. A strong economy tends to have higher spending and therefore business earns higher profits. Conversely, when activity slows, profits decline, and stock prices fall.

But recessions and market sell-offs don’t often happen in tandem. Investors are forward-looking, meaning that equity market declines generally occur ahead of recessions being officially recognised. The news is already being reflected in today’s prices.

As a timely example, the coronavirus pandemic was the catalyst for the most recent recession in 2020. Across February and March, UK stocks dropped by 23%. By the time a recession was officially declared in August that same year, the market had already rallied 29% from its March lows. Those who had sold out early risked missing out on the sharp recovery. Those who read our May 2020 guide to keeping your balance during volatile periods would have seen the benefits of staying invested.

Long term data

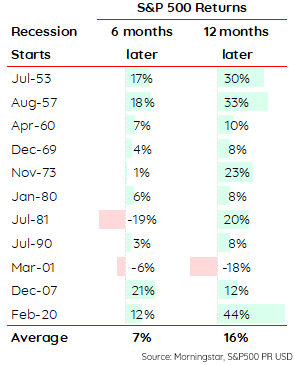

We can go beyond the recent pandemic to consider past behaviour. Looking at the S&P 500 index allows us to track data from the last 11 recessions in the US and the impact on its stock market.

The table below shows the returns on the S&P 500 index six and twelve months after the start of each recession.

Perhaps surprisingly, the average return six months on from the start of a recession is 7%. After 12 months that figure rises to 16%.

On average, cumulative returns grow increasingly positive the further out you look following a recession.

It supports the principle that the longer you stay invested the less likely you are to experience losses.

It also serves as a reminder that the stock market is not the economy, and vice versa. Investing is predictive, so by the time a recession shows in the data investors are already eager to buy into the recovery.

How to approach a downturn

No one knows precisely when we will enter a recession again. And therefore, it’s important to always be prepared for an economic or market downturn rather than try to predict it. For portfolios, one of the best ways to prepare is through broad diversification.

Recession or not, trying to time the market is virtually impossible. There is no reliable way of knowing when we’ve reached the bottom, nor when the rebound might happen. Attempting to do so risks missing out on the best days in the market. Indeed, just last month the S&P 500 surged 9.1%, setting July 2022 as the index’s best monthly performance in nearly two years.

Ultimately, an obsession with recession is unhealthy because it can lead to the wrong conclusions about the direction of markets. Long term investors need simply to stay the course and maintain their diversification.

While today’s outlook is unsettled, remember that in the months following the deep 2007/08 recession, it was only months before “economic recovery” and “boom” were topping Google’s search leaderboard once again.

Important information

This document does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown above. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22.

<< Back to Insights

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.