What happens next?

14th November 2023

It’s often said that history never repeats itself, but it often rhymes.

Take these headlines:

“UK rates rise to 5.25%” or

“Recession fears hit stock markets” or

“Oil surge sparks inflation fears”

Source: Financial Times, BBC.

Sound familiar?

All are from 2007 to 2008 amidst the global financial crisis, but none would look out of place on the front pages today.

We launched Edison in 2007 and the first two years in business felt very much like the most recent two. The poor performance in the stock markets meant that our balanced strategy was down around 5% per annum and interest rates of over 5% were starting to look attractive.

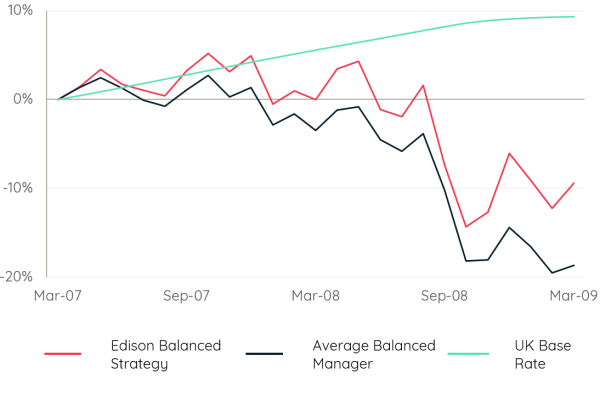

The chart below shows the performance of Edison’s balanced strategy (red line), the average balanced manager (blue line, as measured by the Morningstar GBP 40-60% Equity benchmark) and the return on cash earning the UK base rate (green line).

Figure 1 – Cumulative total returns, April 2007 to March 2009. Source: Edison, Morningstar.

By 2009, some investors were starting to ask themselves:

“Should I sell, go to cash and wait for the recovery, or remain invested and wait for the recovery?”

The risk of going to cash is that you miss the recovery because you’re too slow to get back in and the risk of remaining invested is markets fall further before they recover.

We know, historically speaking, staying invested is more likely to generate higher long-term returns, but there are times when it can test an investor’s patience.

So, let’s take a look at what happened after those first two years: Interest rates fell quickly, markets began to recover, and Edison’s investment strategies posted strong returns.

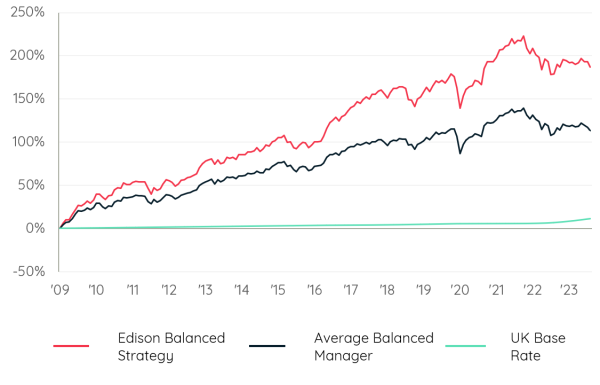

From April 2009 to October 2023, Edison’s balanced strategy returned 187%. The average balanced manager returned 113%. Meanwhile, leaving your money on deposit earning interest at the UK base rate would have returned 11%. It is worth noting that for most of this period it was near impossible to find a savings account paying the base rate.

Figure 2 – Cumulative total returns, April 2009 to October 2023. Source: Edison, Morningstar.

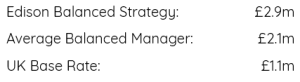

In cash terms, the difference in outcomes is stark. Taking a starting value of £1 million in April 2009, the ending value by October 2023 would be as follows:

Source: Edison, Morningstar.

In hindsight, the best choice for the Balanced investor was clear. Staying invested paid off, as did accepting that the cost of earning superior long-term returns is dealing with short-term drawdowns.

Those that panic and sell to cash risk missing out on the recovery, locking-in losses at the bottom of the market.

Rebounds happen, sometimes quickly and sometimes more slowly. They are compensation for the volatility that investors endure. If you are not invested when they happen, you will never earn those returns.

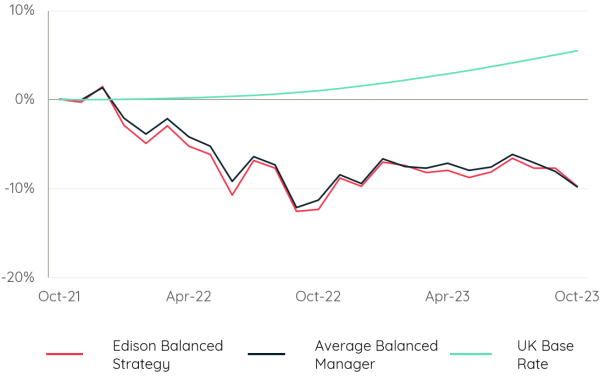

Back to 2023 and the chart below shows that investors today are faced with a similar decision as investors faced back in 2009.

Figure 3 – Cumulative total returns, November 2021 to October 2023. Source: Edison, Morningstar.

There have been clear reasons for the current market downturn. A hangover from Covid, Russia invading Ukraine, spiralling inflation and rising interest rates.

But our message has not changed: investors earn more in the good years than they lose in the bad years. Better times are coming for those that have the patience to stick it out.

If you have any questions on the above or to find out more about our investment service, please call 020 7287 2225 or email hello@edisonwm.com.

Important information

This document does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

Figure 1, Figure 2 and Figure 3 source: Edison, Morningstar. All investment returns calculated from Morningstar in GBP on a total return basis. Edison Balanced Strategy: Edison Core Balanced Strategy; Average Balanced Manager: EAA Fund GBP Allocation 40-60% Equity; UK Base Rate. Figure 1: 01/04/2007 – 31/03/2009. Figure 2: 01/04/2009 – 31/10/2023. Figure 3: 01/11/2021 – 31/10/2023.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown above. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22.

<< Back to Insights

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.