Cash is king?

19th May 2023

Charles II was a 17th century English monarch who ruled during a time of significant political and religious conflict. It was an era of “greats” but ostensibly the wrong sort; The Great Plague of 1665, followed by the Great Fire of London just a year later. There were economic challenges too stemming from a downturn in trade and a familiar bout of high inflation. Sadly, the Bank of England wasn’t yet in existence to lend a hand.

Newly crowned King Charles III will almost certainly hope for an easier reign than his ancestor and namesake.

2023 has not been without questions and worries, and with it, repeats of the adage “cash is king”. The phrase was first coined during the 1987 stock market crash, ominously known as Black Monday. It pops up when market volatility increases, and investor sentiment becomes cautious. After all, the predictability of cash can feel reassuring when uncertainty is in the air.

The predictability of cash can feel reassuring

When we talk about holding cash, we are referring to keeping a portion of assets in bank deposits or cash equivalents, such as savings accounts, money market funds or short-term bonds. These assets are low-risk and highly liquid, meaning that they can be easily converted to cash without losing face value (at least in theory).

These deposits may also be able to earn interest, which since the 2008 financial crisis – and the resulting era of near-zero interest rates – has amounted to very little. But the Bank of England (established in 1694, for those interested) has recently undertaken its fastest interest rate hiking cycle in decades.

As the Bank’s base rates feed into the financial sector, the result is an array of increasingly appealing savings rates, particularly given the slim pickings of the last fifteen years. Which begs the question, is now a good time to hold more money in cash?

Irrespective of savings rates, it is generally advised to have an emergency cash buffer of around 6 months’ living expenses. If money is needed unexpectedly or at short notice, a buffer avoids having to sell a portfolio at inopportune moments, for example if markets are already down.

As a liquid and low-risk asset, cash also provides a cushion against market volatility. Cash can help to reduce overall portfolio risk during market stress and provide a source of funds to potentially buy assets at lower prices.

History shows two things however: low risk typically means low reward, and timing the market is notoriously difficult to get right consistently. Plus, there may be other downsides.

The certainty of savings interest is certainly appealing. But even at current rates they still lag a long way behind rises in the cost of living. So, beyond holding the usual emergency cash reserves, do savings accounts offer enough of a “reward”?

The latest figure for CPI inflation was 10.1% in March 2023, more than three times the average typical instant access savings account which offers around 3% (despite a base rate of 4.25% that month). Looking at these figures, cash savings accounts will be losing value in real terms – in other words, it will be worth less once inflation is accounted for.

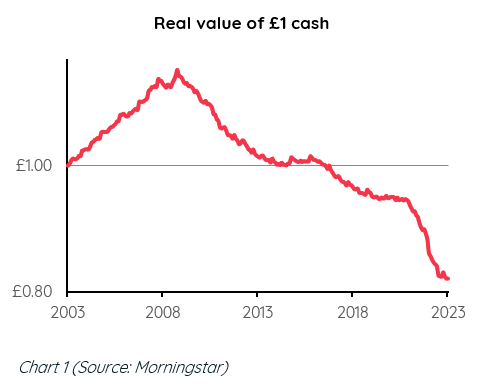

This is not a recent phenomenon either. Chart 1, above, plots the UK base rate with CPI inflation deducted. Compounded over 20 years, savers have been left worse off in terms of real spending power – each pound saved 20-years ago is now worth 82p once inflation is factored in.

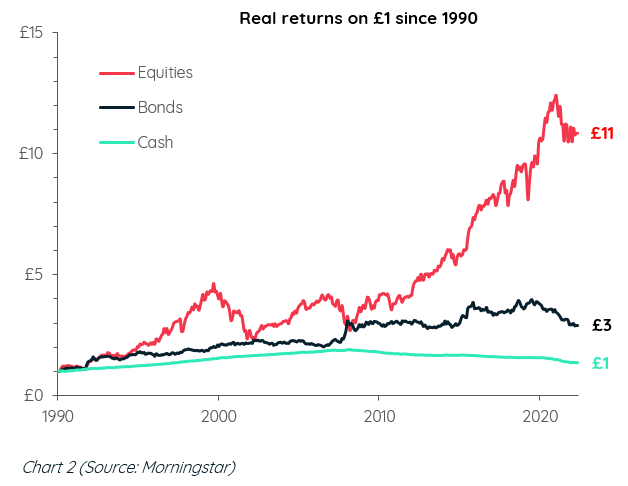

Given the impact of inflation, cash can no longer be considered completely “risk free”. Indeed, there are other assets that could be held which might stand a better chance of outpacing price rises. Chart 2, below, shows the real return on £1 invested, since 1990.

By April 2023, a £1 equity investment was worth £11 even after adjusting for inflation. Bond investments tripled their starting value to £3 in real terms. Meanwhile, the real return on cash was largely flat.

Holding too much cash for long periods can therefore be costly. Firstly, inflation cumulatively eats away at spending power and second, there is also a very low chance of accurately predicting the exact rare moment when cash will outperform other assets.

Short-term objectives are likely best addressed through cash savings because of the certainty it provides. For long-term objectives, they may be best achieved through investing in assets which are more likely to generate returns in excess of inflation.

It follows then that investing is for those able to commit to a longer time horizon. Of course, it is important to remember that investing does come with risks. The stock market can be volatile and there is always the possibility of losing money. However, the key to successful investing is taking a long-term approach, riding the ups and the downs, and diversifying across different asset classes and sectors. Chart 2 demonstrates both the higher relative volatility across invested assets (equities and bonds) and the long-term rewards of being able to tolerate it.

Getting the right mix of those assets will depend on personal factors such as the investor’s time horizon, risk tolerance, spending requirements and overall financial situation. These should all play a part. And only once they are blended into a cohesive plan will you have a portfolio that’s truly fit for a King.

If you have any questions on the above or to find out more about our investment service, please call 020 7287 2225 or email hello@edisonwm.com.

Important information

This document does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

Chart 1 and Chart 2 source: Morningstar. Investment Returns calculated from Morningstar in GBP, shown in real terms using UK Consumer Price Index (CPI) as a measure of inflation. Equities: S&P Global 1200 Index; Bonds: Bloomberg Global Aggregate Index; Cash: UK Base Rate. Chart 1 shows the real Cash return between 30/04/2003 – 30/04/2023. Chart 2 shows the real return of Equities, Bonds & Cash between 31/12/1990 – 30/04/2023.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown above. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22.

<< Back to Insights

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.