Planning for the good decisions, not the quick ones

This insight is based on an interview which you can watch on the Divorsee YouTube channel. It features on Divorsee.com, a centralised network of industry leading and recognised experts who operate within the divorce sphere. Written by Alice Sanders.

12th April 2022

Divorce means a new start, new possibilities, but also new circumstances; personal and financial.

Not surprisingly, financial security ranks high on the list of priorities for divorcees, especially where their earning potential is low, their income is derived from capital and there are financial dependants.

It takes time to get used to a new life and establish a new normality, so how and when should divorcees make those big financial decisions that will affect a future that is still uncertain for them?

We recommend that divorcees prioritise these big decisions, starting early on with the basics – how much do they need to live on and only when they are settled tackle the bigger decisions around investing for their future.

Solicitors routinely encourage their clients to take control of their financial situation as soon as possible, even possibly during the divorce process, and may recommend financial planners. But so often we hear that their offer of a referral has been declined.

And the reasons for not taking the first step are all heartfelt and all understandable. It’s too soon. Feeling uncertain about the future. Inexperienced in handling money/investments. Fear of making the wrong decision. Not knowing where to start.

Faced with several big financial decisions, prioritise and tackle them one at a time

But why do anything?

If we had an infinite amount of money, we would not need to invest. Ever. We do so because, over time, investments such as shares deliver higher returns than, say, cash. And we need those returns to achieve the goals that require spending more money than we already have.

But investing carries risk. Deciding how much risk to take can feel like a difficult decision if you don’t have much experience of investing.

Small steps are easier

This is where sitting down with a financial planner will help. Financial planning is all about seeing things in the round, now and in the future, focusing on the individual’s circumstances and what is important to them. A financial planner knows the right questions to ask, can break down financial decisions so that they are manageable and will help put in place a plan for the future. This plan may or may not require investing to achieve the individual’s goals for the future.

In the absence of well-defined goals however, the planner can put together a ‘holding plan’. The purpose of this plan will be to:

- Avoid making poor decisions in the short term

- Buy some time to think, settle into a new lifestyle and ponder the future

- Explore professional options

- Agree a timetable so that the bigger decisions are not forgotten

The aim is to give the assurance to progress short term goals such as re-housing and buy some time to think be it 6 months, a year or longer.

How much time does this take?

Typically, a financial planner needs 4 hours with their client, split over an initial meeting to discuss circumstances and a second meeting to go through recommendations. And there might be some forms too.

How much does it cost?

That will depend on the planner but can be charged on a fixed cost basis or an hourly rate. They can give a one-off piece of advice or an ongoing service, which we believe is more advisable.

Those first crucial steps… and smaller ones too

In the first year, these are some of the issues a divorcee should seek advice on.

1. Understand what spending is sustainable

Understanding current monthly income and expenses is important. Some spending is critical (household bills) and some is flexible (spending on holidays).

Some accessible money should be set aside for unexpected expenses, such as home or car repairs, and emergencies.

Being reliant on capital to support expenditure has its drawbacks. Fluctuating investment returns, tax and the cost of investing will have a bearing on what is a sustainable level of expenditure. A financial planner can help understand what this is, accounting for the spending that must be met and that which is flexible.

“Cashflow modelling will give some insight into the future. It’s all about how an individual can achieve the things that are important to them with the least risk possible.” – Justin Small, Director

2. Re-housing comfortably

Buying a new home requires a large commitment of capital, especially in the South East.

It is hard to recover from overspending on property in the early years. Financial planning advice can help understand the trade-off between spending now and future needs. It can give individuals that expensive dream home, confident that they fully understand what cut backs they will need to make elsewhere.

Example

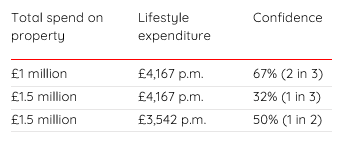

Jane, 55, receives a cash settlement of £3 million to re-house and support her lifestyle. Her lifestyle expenditure (after tax) is £50,000 per annum or £4,167 per month. Jane is unsure how much she should spend on a new home. All the capital will be spent down as her children are financially independent. To be prudent we assumed life expectancy of 100.

To be 50% confident means that ‘on average’ Jane will be able to meet her expenditure and is what we typically describe as reasonable.

So, spending (including all costs of purchase) £1 million on a new home suggests Jane has an expected 67% chance of supporting her net spending which, as far as our experience goes, is typically considered more than acceptable.

Spending £1.5 million reduces the confidence to 32% which is below what we would describe as reasonable and suggests that Jane may need to consider making some changes.

For example, Jane can consider reducing her spending by £625 per month, or supplementing investment returns with full or part time work to have reasonable confidence of spending £1.5million on a property.

These calculations will be reiterated several times to cater for different eventualities and in the end, Jane will work out a plan which she is happy with.

“Your home is important for maintaining relationships and living well. In London especially, it’s also a major expense. We help clients work out a safe amount to spend on property. And sometimes, it’s higher than they were expecting.” – Scott Inglis, Chartered Financial Planner

3. Cash management

Depending on circumstances, it is likely that capital from a settlement will need to be invested. But until then, a financial planner can help manage cash.

As a general rule of thumb, it is not a good idea to leave significant balances in current accounts. Current rates of interest are around 0.5% which is significantly lower than inflation. In other words, individuals stuck in low interest accounts are a little poorer every day.

Holding lots of cash means you are getting a little poorer every day

Deposit and current accounts offer instant access and are useful for covering unexpected expenses but divorcees should be mindful of the Financial services Compensation Scheme (FSCS) protection limits.

The FSCS pays compensation (up to certain limits) to customers if a financial institution is unable to meet its commitments. The limit is usually £85,000 per person per financial institution but this limit is increased to £1million for 6 months following an event that’s resulted in having a higher cash balance than normal, for example, a divorce or the sale of a house.

Beyond that, National Savings & Investment (NS&I) accounts are instant access but as the agency is government backed, all savings are 100% guaranteed.

Alternatively, longer term deposit accounts with restricted access also offer competitive rates but divorcees should be mindful of the restrictions.

This strategy of depositing in a spread of carefully selected accounts can retain sufficient access, give peace of mind and improve the overall rate of interest. It is relatively easy to manage and flexible.

“In some cases our clients will ask us to open a cash account which they cannot spend directly from. Every month we transfer their regular spending amount to their current account. They still have access to the larger account of course, but this way there is no risk of overspending which makes day-to-day budgeting far easier.” – Alice Sanders, Financial Planner

4. Don’t forget your ISAs

A financial planner can carry out essential financial ‘maintenance’ throughout the year too.

Individual Savings Accounts (ISA) are tax efficient savings accounts. Interest, growth and income accrued in an ISA is free of tax. The annual contribution is currently limited to £20,000. If not used, it can’t be carried over to the following year.

In the grand scheme of things, this may not seem like a material amount but with time and tax-free growth, ISAs can become a valuable source of tax free income as any withdrawals are tax-free too.

5. Investments

Any existing or investments transferred in a settlement, including those in a pension, will need to be reviewed in terms of short term risk or to free up cash. A financial planner can work out how to take advantage of the Capital Gains Tax (CGT) allowance, which is £12,300 for the 2021/22 tax year. There is no tax on any gain or profit from the sale of shares or other investments up to the CGT allowance in that tax year.

6. Pensions

When the provider of a pension plan accepts a pension share they may automatically invest it into the existing choice of investment fund(s). This choice may not have been reviewed for some time or may not be suitable for a higher pension value. It should be reviewed before the share is received. Switching funds within a pension usually requires a completion of a form, or an instruction from the financial planner.

Pensions can be passed down to beneficiaries, now almost anyone, sometimes very tax efficiently. Nominating beneficiaries is easy with a ‘Death Benefit Nomination’ form, available from the pension provider. It costs nothing and can be amended at any time.

Pensions can be complicated and there could be other action to take, such as avoiding a Lifetime Allowance charge on larger pensions or applying for protection. Again a financial planner will be able to spot these.

7. Other areas to consider

Just like Death Benefit Nomination forms, Wills and Lasting Powers of Attorney will need to be redrafted to reflect new circumstances and wishes.

Simple, no-nonsense approach

To loosely quote The Beach Boys “some want to get there fast, and some want to take it slow.” We are all different, but everyone wants to feel secure and in control. To achieve this the focus should be on making good decisions, not necessarily the quickest ones.

We are all different, but everyone wants to feel secure and in control

At Edison we have a team of financial planners and investment managers. No matter what the need or the urgency, we have it covered.

And over the past 10 years we have helped many divorcees. You can read the real story of one such divorcee here.

“We’re always surprised when new clients come to a first meeting clutching statements and asking about our views on the investment markets, as if talking about anything else would be out of place. But it’s nothing compared to their surprise when we ask them what’s really on their mind.” – André Pimenta, Director

First step…

A first meeting with an adviser at Edison is about:

- Understanding what advice is needed

- Agreeing if we are the right firm to help, or

- Just some initial DIY guidance

An initial consultation is at our own cost and, obviously, free of obligation.

If you have any questions on the above or to find out more about our financial planning service please call 020 7287 2225 or email hello@edisonwm.com.

You can read more about us by visiting our website www.edisonwm.com.

Important information

The above is a simplification of the legislation and does not constitute advice. The Financial Conduct Authority does not regulate Tax Planning, Cashflow Modelling and Will Writing. The content is based on the legislation based at the time of writing, which is subject to change.

Although we have not written specifically about investing, it is important to remember that the value of an investment and the income from it could go down as well as up. In most cases, returns at the end of the investment period are not guaranteed and you may get back less than you originally invested.

<< Back to Insights

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.